Renters Insurance in and around Titusville

Renters of Titusville, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

It may feel like a lot to think through work, family events, keeping up with friends, as well as providers and deductibles for renters insurance. State Farm offers straightforward assistance and remarkable coverage for your souvenirs, electronics and home gadgets in your rented condo. When mishaps occur, State Farm can help.

Renters of Titusville, State Farm can cover you

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like the least of your concerns, and you're wondering if having it is actually beneficial. But take a moment to think about the cost of replacing all the stuff in your rented house. State Farm's Renters insurance can help when windstorms or tornadoes damage your stuff.

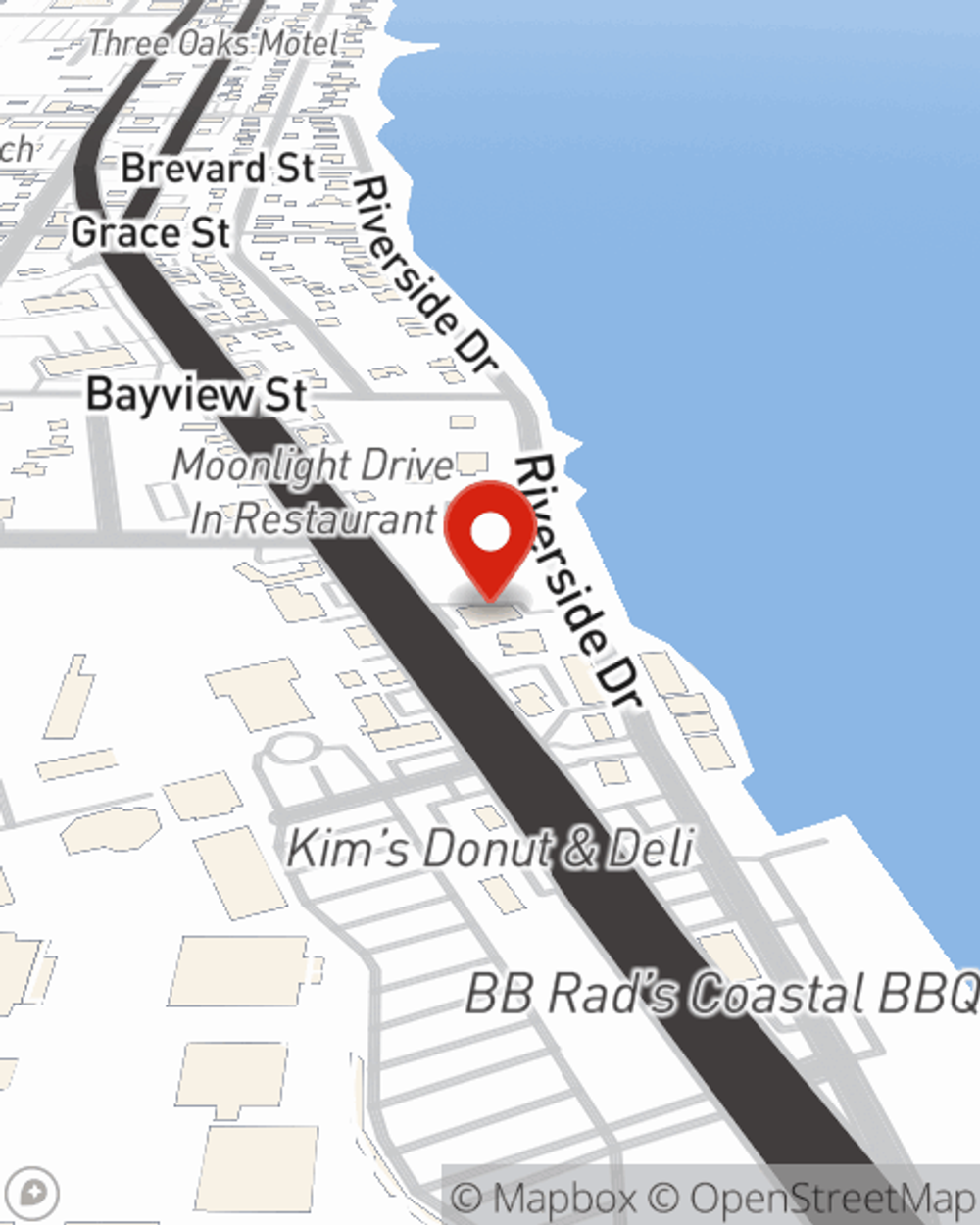

State Farm is a value-driven provider of renters insurance in your neighborhood, Titusville. Call or email agent Kim Steele today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Kim at (321) 267-7977 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.